The Potential for Improved Implementation of Microfinance through AI-Driven Targeting

Abstract

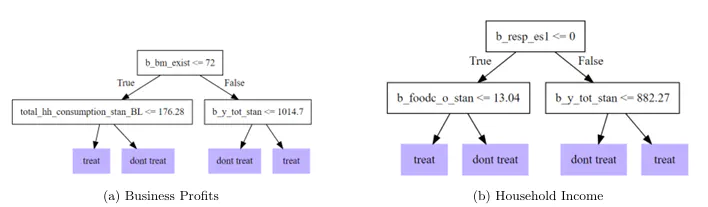

Policy interventions– especially antipoverty– often provide social returns which are either disappointing in magnitude or cost-effectiveness. In many cases, the core of this issue may be attributed to treatment effect heterogeneity. That is, some program recipients exhibit high marginal benefit per-dollar of program cost while others are perhaps better served by alternative interventions. Effective program targeting based partially on desired impact is thus a critical addendum to typical need-based targeting. I apply modern machine learning (ML) approaches to assess the scope for improving microfinance – a large-scale antipoverty program with historically mixed returns – by targeting on predicted treatment effect. First, I utilize a set of RCTs to establish benchmark program impacts, confirming that average returns are small for a generic set of first- and second-order outcomes. Next, I develop a framework for employing the generalized random forest estimator of individualized treatment effects to perform subsample analysis by “counterfactually” reallocating treatment among the upper quantiles of the distribution. Consistent with large heterogeneity, I find that “gains” to impact targeting are often substantial. The average impact among the targeted subset is between $60– 480 (90– 567%) larger for bi-weekly business profits, revenues, and expenditures and between $147– 711 (664– 1,373%) larger for bi-weekly household income in case studies with high program take-up. Finally, I derive simplified targeting rules using GMM-matched policy trees on recipient characteristics in order to illustrate some “quick fixes” to the existing policy structure. Results suggest meaningful improvements may exist from a simple reallocation of treatment in the microfinance setting and other settings with a wide degree of heterogeneity.

Type